OVER a million private renters will benefit from a huge income boost to help with record-high housing costs in days.

Local Housing Allowance (LHA) rates will rise on Monday, April 1.

The allowance sets the maximum amount people renting from a private landlord can claim in Housing Benefit or Universal Credit.

From April, rates will be increased to cover the cheapest 30% of local market rents in the 12 months before September 2023 after being frozen since 2020.

The allowance aims to ensure that anyone renting a home among the cheapest 30% of private rental properties in their area can cover their entire rent with just their benefit payments.

Read more in money

However, the exact amount you can claim towards housing costs depends on the house prices in your area and the size of the property you rent.

It comes as a new report published by the House of Commons Work and Pensions Committee has called for the UK Government to introduce a new ‘”uprating guarantee” to the LHA rate each year to “end the uncertainty faced by people claiming benefits“.

Under these recommendations, the government would be required to set out its reasoning to Parliament if it decided not to increase LHA each year in line with the 30th percentile of local rents.

Rates are set differently for shared, one bed, two bed, three bed and four bed accommodation.

Most read in Money

The majority of households live in three bedroom properties, according to the Office for National Statistics (ONS).

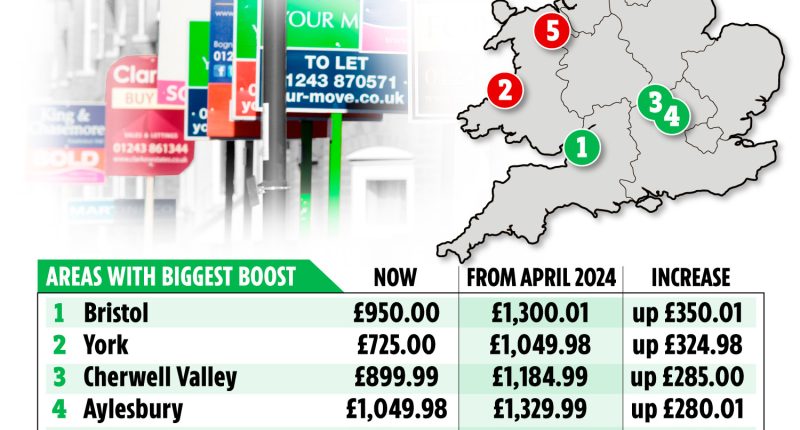

We’ve included some figures in the graphic above to show the areas with the biggest and smallest LHA boosts.

For example, those living in a three bedroom property in Bristol could see their rates rise by up to £350.01 a month or a whopping £4,200.12 a year.

The overall boost to LHA will benefit over 1.6million families and give a typical renter at least £800 a year more towards their housing costs, according to the Department for Work and Pensions (DWP).

Work and Pensions Secretary Mel Stride said in January: “Housing costs are the number one expense for families.

“This £7 billion boost to Local Housing Allowance over the next five years, along with our landmark Back to Work reforms, reflects our fair approach to welfare – helping people into employment while protecting the most vulnerable with the unprecedented cost of living support.”

But it’s not all good news, and some experts have argued that how the new LHA rates have been calculated means that the support may still fall short for some families.

Alex Clegg, economist at the Resolution Foundation, said earlier this year: “The increase to LHA rates from April is very welcome news for low-income renters, who could see their housing support boosted by £80 per week for a three bed property.

“However, the way that LHA rates are calculated means that housing support will fall short of covering many households’ rental costs, as rents have continued to rise since the new rates were announced back in September.”

LHA rates are set using data on private rents in the 12 months up to September before the new rates come into force.

This means that rent rises from September to April are not factored in, and some of the information used to set the new rates will come from as far back as October 2022, when rents were around 9% lower than they are projected to be in April.

READ MORE SUN STORIES

While it’s a welcome boost for renters, there’s still other help you can get if you’re struggling, like discretionary payments.

You can check your LHA rates on the government website at lha-direct.voa.gov.uk/

What is Local Housing Allowance?

LOCAL Housing Allowance (LHA) sets the maximum amount people renting from a private landlord can claim in Housing Benefit or Universal Credit.

Around 38% of England’s 4.6million private renters receive some form of housing benefit.

The amount you can claim depends on the area you live in and the size of the property you rent.

LHA rates are usually set on April 1 each year for the following 12 months, but the current rate has been frozen since 2020.

However, rents have increased significantly since then.

In the 12 months to January 2023, private rents rose by an average of 4.4% across the UK, according to the Index of Private Housing Rental Prices.

It’s estimated that 844,000 households now have rents higher than the maximum level that LHA will cover.

New analysis by Zoopla for ITV found the typical rental cost for a two bedroom home in England is around 22% higher than the average LHA rate.

Other perks of LHA have gradually been clawed back since it was introduced in 2008.

The allowance originally let claimants “keep the difference” of up to £15 per week, so those who chose to rent a cheaper property could increase their available income instead. However, this was scrapped in 2011.

The government also planned to introduce LHA to the social housing sector from April 2019, but the proposals were abandoned in 2017.