Savers looking to get into the habit of saving this year may be tempted by a regular saver.

These accounts encourage people to put aside a fixed amount every month to help it snowball it into a bigger pot – and offer high headline rates.

For example, the top regular saver account from Nationwide pays an interest rate of 8 per cent and allows savers to stow away £200 a month.

In exchange for higher rates many regular saver deals have strings attached, such as withdrawal restrictions and limits to the maximum amount you can be save in them.

Regular savers can encourage savers who want to save little and often to build up a savings pot from scratch

Regular savers open to new customers typically pay between 5 and 7 per cent in interest, but limit contributions to between £300 and £500 a month – and some even less.

They also don’t pay the headline rate that is stated on the tin – we explain more below.

This week, Aldermore Bank has launched a regular saver which pays 5.25 per cent and, unusually, it has no withdrawal restrictions — meaning savers can access their money whenever they like for withdrawals or transfers.

This is not the norm for this type of account, as regular savers mostly do not allow withdrawals — and can even close the account if you try to withdraw any money.

Savers can start depositing as little as £25 a month in the account and the maximum you can save in a calendar month is £300.

A saver tucking away the maximum £300 a month in Aldermore’s account would earn £102.27 in interest by the end of the 12 month term. When the term ends, the account balance and the interest earned will be transferred to an easy-access account

James Blower, founder of website Savings Guru, says: ‘For savers who have made a New Years resolution to save more this year, Aldermore Bank’s 5.25 per cent regular saver is worth a look.

‘It pays the same as the base rate and savers can save from just £25 per month.

‘Unlike many regular savers, which are fixed for the year, Aldermore permits unlimited withdrawals.’

Other regular saver accounts paying high rates are Skipton Building Society’s regular saver which pays 7.5 per cent and allows you to save up to £250 a month.

You must have been a member of Skipton Building Society since before 31 May 2023 to get this deal though.

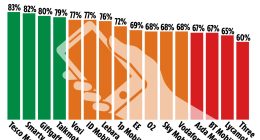

Building Societies tend to offer premier rates to loyal customers, This is Money’s analysis of regular saver rates shows.

High Street banks are less likely to reward loyalty, and often advertise better deals to new customers to lure in new business.

How is interest calculated on regular savers?

Savers who are considering taking out a regular saver over other types of accounts should be aware that interest on regular saver accounts is calculated on the growing balance.

The way interest rates are worked out on regular saver deals can trip savers up and mean they earn far less than they think.

As an example, if you were to put the maximum £200 monthly allowance into Nationwide’s 8 per cent regular saver, you’d end up with £104 interest, which is the equivalent of 4.33 per cent of the end balance of £2,400 and not 8 per cent.

Banks do point this fact out in their terms and conditions, but it can be easily missed.

Would your money be better off in an easy-access account?

Depending on how much they have to put away, savers could earn more in interest if they put their money in one of the top paying easy-access accounts.

At the moment, the best easy-access account is Ulster Bank’s Loyalty saver which pays 5.2 per cent — just 0.05 percentage points lower than the rate advertised on Aldermore’s regular saver.

Savers only get the headline 5.2 per cent rate if they save £5,000 or more in the account though. Amounts less than this will earn interest at a rate of 2.25 per cent.

A saver who puts Aldermore’s maximum of £300 a month or £3,600 into Ulster Bank’s easy-access account would earn £81 in interest. That’s £21.27 less than it would earn if it was stashed in Aldermore’s regular saver by the end of the 12 month term.

Earl Shilton Building Society’s easy-access deal pays 5.15 per cent interest on balances starting from £5,000, so a saver putting this amount in would earn £257.50 in interest. This account only allows 1 withdrawal a year despite branding itself as easy-access and the headline rate includes a bonus.

Savers who want to save little and often will find regular savers the most useful as they help encourage a savings habit among consumers.

They have traditionally been aimed at groups who needed help to save for one big event a year whether that is Christmas or a wedding.