What makes someone good at managing their money? Sure, it involves keeping a budget, understanding how finance works and knowing how to make it. But a growing number of financial experts believe that’s only half the battle. Understanding what is known as your ‘money personality’ is just as important – and yet it is often overlooked.

Your money personality is how you interact with it – whether, for example, you tend to splurge or save militantly, don’t care about money or worry about it all the time. These attitudes to money are often instilled in us from the stories that we have heard about it through childhood and throughout our lives.

For example, we may have experienced scarcity or seen money used to express love, or come to associate it with status. These deep-seated attitudes affect all of our interactions with money, from how easy we find it to save, to whether we spend on the things that matter to us or fritter it away.

Ken Honda, a financial planner, money guru and bestselling author of Happy Money: The Japanese Art Of Making Peace With Your Money, is one of several financial experts who have identified a list of money personality types that we all fall into. Here, Wealth & Personal Finance investigates his seven Money Personalities and asks experts their tips for managing your wealth depending on which you most identify with. Honda’s book also has many more ideas about exploring your money personality.

Remember that you are likely to display attributes of more than one – and your money personality may change over time and in different circumstances. They are not designed to be prescriptive or inevitable. Rather than being fatalistic and resigning yourself to a certain money personality, they can be useful to help analyse your own behaviours and change those holding you back.

As leading financial wellbeing expert Jason Butler puts it: ‘Money personalities don’t define us, but they can help us understand why we do things and what we can do to change it.’

Shah Abbasi, at money coach Octopus Money, believes that understanding money personalities of your loved ones can also help build harmony. ‘There’s so much friction in relationships when it comes to money,’ he says. ‘I think so many couples would align much better on how they view their finances if they took the time to understand and share their money personalities.’

So, here are the seven money personalities. Which are you?

Compulsive Saver

Do you love finding a bargain and get a thrill when you check your savings account and see it steadily rising in value? If so, you could be a compulsive saver. This personality type often has bad memories about money – or a lack of it – from their childhood, and see saving money as key to ensuring they never experience the same again.

Expert tips

1) Have a financial plan and budget. Alistair Ford, Money Coach at Octopus Money, says: ‘People can become Compulsive Savers because they don’t know how much money they need to achieve their financial goals. They want to avoid overspending, but with no frame of reference, they end up avoiding spending at all. A financial plan and supporting budget can be liberating, as they often find they have more capacity to spend than they thought and can do so without fear that they’re compromising their long-term goals.’

Compulsive saver types often have bad memories about money – or a lack of it – from their childhood, and see saving money as key to ensuring they never experience the same again

2) Make sure you’re saving tax- free. If you are stashing money into a regular savings account, you risk breaching your Personal Savings Allowance, which limits the amount of interest you can earn tax-free to £1,000 for basic rate and £500 for higher rate taxpayers. Alice Haine, at investment platform Bestinvest by Evelyn Partners, says: ‘Make sure you use your Isa allowance to keep your savings interest tax free.’

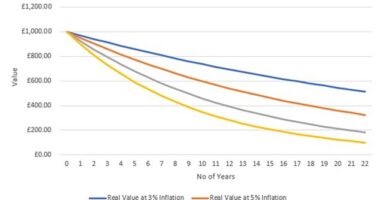

3) Make your money work hard. Haine says: ‘Money held in a low-rate savings account won’t be delivering an adequate return so hunting out a better savings rate or considering whether some of that money could work even harder invested over the long term through a Stocks & Shares Isa is important.’

Compulsive Spender

Do you enjoy splashing the cash and live by the spending philosophy that ‘you can’t take it with you?’ If so, you may be a Compulsive Spender.

This personality tends to spend to feel more control over their surroundings, or perhaps a sense of self-respect or worth.

According to Ken Honda, Compulsive Spenders are often the children of Compulsive Savers, and their attitude to money comes in reaction to enforced frugality or judgments about spending.

Expert tips

1) Wait for a set period before spending. Shah Abbasi recommends a trick for Compulsive Spenders. Set a rule where you wait a certain amount of time before buying something so as to create a time gap between the initial urge to purchase and actually spending the money. This can help prevent making reactive, emotional spending decisions without giving it some thought.’

2) Don’t store your card details with online retailers. Creating friction in the purchasing process can help slow you down and give time to consider whether it is really worth it. Being forced to enter your bank details, rather than having them saved, can help, says Abbasi.

3) Create a budget that balances spending with saving goals. Megan Rimmer, chartered financial planner at Quilter Cheviot, says: ‘This can help Compulsive Spenders to enjoy the best of both worlds without compromising their financial future.’

Compulsive Moneymaker

Do you spend a lot of your energy improving your ability to make more money and feel little guilt over prioritising work? If so, consider yourself a Compulsive Moneymaker.

People with this trait tend to feed off the response of others to their financial success, says Ken Honda. However, no amount of money will be enough for them to stop seeking that recognition.

Expert tips

1) Work out what you are making money for. Abbasi recommends having milestones for what you do with your money – rather than simply making as much as possible. ‘Money doesn’t make you happy, it’s all about what you do with it,’ he says.

‘If what you do with the money has no purpose (or you don’t have a target) you may never think you have enough.

‘If you’re prioritising making money over everything else, you need to proactively give yourself some time to prioritise what to do with it.’

2) Make sure your wealth is balanced. Moneymakers may be prepared to take on more risk, but they should think carefully first, warns Haine. ‘Piling all your money into risky assets in the hope of making a quick return may not pay off,’ she adds.

Indifferent to Money

Do you just get on with life as if money is not an important factor? You need money to live, but don’t spend much time concerning yourself with managing it or thinking too much about it.

Indifferent to Money people are also likely to leave sorting out the finances to someone else, such as their spouse.

This attitude is harmless until it isn’t. In other words, if you have enough money not to have to worry – or have someone capable whom you can trust to oversee yours, then you’re fine. But as soon as things go wrong or the person on whom you rely is no longer available or falls short, you’re in trouble. People with this personality type tend to have had a fairly financially comfortable upbringing, says Ken Honda.

Expert tips

1) Check in with your money. Emma Gosling, Money Coach at Octopus Money, says: ‘If you don’t engage with money, don’t expect it to engage with you. Dealing with money is a bit like having a relationship – if you ignore your partner, you’re not likely to develop a beneficial two-way relationship.’

2) Make sure your money is working hard for you. If you are indifferent, you may not be getting the best deals on your savings. Haine advises checking whether there are better options.

3) Learn the basics of personal finance and saving. Megan Rimmer, chartered financial planner at Quilter Cheviot, says: ‘What needs to be made clear for this personality type is that doing nothing is also a choice that has ramifications. A nudge towards understanding the basics of personal finance can transform indifference into proactive financial health.’

Saver-Splurger

ARE you quite a conscientious saver – but then suddenly get the urge to splash out? Then you might be a Saver-Splurger.

People with this personality tend to carefully save to bring control to their lives, but intermittently their control cracks and they spend dramatically. The problem is that when they do splash out, they often make poor, spontaneous decisions and end up regretting it.

Expert tips

1) Budget gently. Leading financial wellbeing expert Jason Butler says that Saver-Splurgers follow similar behaviours to people who diet strictly and then go berserk on treats, or exercise fanatics who fall off the wagon and then don’t work out for days.

Saver-splurger types carefully save to bring control to their lives, but intermittently their control cracks and they spend dramatically

He says the key is not to have such a tight budget that you risk giving up. ‘Don’t oversave,’ he says. ‘If you think you can put aside £100 every month, put £30 in an account that is hard to access and £70 in a separate account that you can get to if you need to.’

2) Plan for spontaneous spending. Butler adds: ‘Don’t decide to cut out splurging completely, but do it thoughtfully. For example, put aside a set budget every month for going on a night out with friends or treating yourself to something you have your eye on.’

3) Start small and build. ‘Learning your spending mentality and changing it is not easy,’ says Butler. ‘Do it gradually and regularly and don’t become dispirited if you don’t do it perfectly – if you’re not making mistakes, you’re not learning.’

Gambler

Do you seek thrills and are willing to take big risks? If so, you could be a Gambler.

This personality type often convinces themselves that they are taking risks to grow their assets, when actually they are just getting caught up in the thrill of the risk taking itself, says Ken Honda. He adds that the Gambler often appears as a mixture of Compulsive Moneymaker and Compulsive Spender.

Expert tips

1) Understand the risks. ‘Taking risks is not a bad thing,’ says Haine. ‘But it’s important to understand the risks, as if you don’t know what you’re doing, you’re gambling.’

2) Know your life stage. The stakes will vary depending on your age and life stage, so you may have to moderate your risk taking at different points in your life, says Haine. ‘Someone in their 70s with a guaranteed income and more money than they need is better placed to take on risk compared to someone in their 40s trying to get rich quick,’ she says.

3) Find ways to sate your risk appetite. Rimmer says that this personality type should construct a well-diversified portfolio to find ways to satisfy their taste for risk, while safeguarding against potential losses. ‘Be on guard, too, against financial scams as the lure of an unbelievable return can prove too much,’ she adds.

Worrier

Do you fret about money regardless of how much you have? Then you fit the personality type of the Worrier.

This kind of worrying tends not to be limited to money but fear about life in general is simply projected on to interactions with money.

Expert tips

1) Learn about money. Money worriers often do so because they don’t understand how it works, for example how investing works or how they can achieve their financial goals. ‘Seeking guidance, for example from a financial coach, can help unpack these concerns and help make informed decisions,’ says Haine.

2) Write a list of the ways you are good with money. Stacey Lowman, financial coach at Claro Wellbeing, says that money worriers tend to lack confidence and suggests making a list of ways they are good with it can help.

‘For example, if you have avoided getting in to debt or check your balances regularly,’ she says, ‘the list will give evidence that you can be good with money, which may help manage your fears.’

3) Carve out a little money in your budget to do something fun. Lowman adds: ‘Giving yourself a little enjoyment with an amount of money you’re comfortable with, without any negative consequences, may help to let you relax a little and see that allocating every penny to a purpose isn’t always a helpful strategy.’

This post first appeared on Dailymail.co.uk