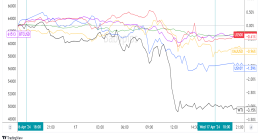

The Australian dollar continued its 2020 dominance, taking the top spot among the major currencies for the week. It’s likely the combination of better-than-expected economic updates from Australia and overall positive global risk sentiment were the drivers for the Aussie’s gains.

Australian Headlines and Economic data

Monday:

Australia PMI holds closet to three-year high despite shipping delays – “The headline index from the survey, the seasonally adjusted IHS Markit Manufacturing Purchasing Managers’ Index edged down from November’s 35-month high of 55.8 to 55.7 in December, pulled lower by supply chain delays which limited firms’ abilities to buy sufficient quantities of inputs.”

This data was likely the catalyst for the Aussie’s broad move higher, along with positive global risk sentiment, likely supported by positive business sentiment updates from around the globe (Korean manufacturing PMI signals sustained expansion at end of 2020, Indian Production and new orders expand further at the end of 2020)

Tuesday:

Australian job advertisements up 9.2% in December – “Job ads are now 5% higher than in December 2019. Taken at face value this suggests the unemployment rate could fall to less than 6% during 2021”

Wednesday:

Australia services PMI climbs to 57.0 in December vs. 55.1 in November – Markit

Thursday:

Australian building approvals jump 2.6% vs. projected 1.9% gain – “Private sector houses rose 6.1%, in seasonally adjusted terms, while private sector dwellings excluding houses fell 3.9%.”

Australia’s trade surplus narrowed from 6.58B AUD to 5.02B AUD

Goods and services debits (imports) rose $2,774m (10%) to $31,370m.

Goods and services credits (exports) rose $1,214m (3%) to $36,393m.

The turn lower in the Aussie against the majors on the session may have been driven by negative risk sentiment, likely a reaction to the disturbing events in Washington, D.C. when the U.S. Capitol was overrun by Trump supporters.

Focus did shift back to positive themes after the U.S. Congress confirmed Biden election, raising the probability even further of more stimulus coming in the U.S., a generally positive risk theme.