With virtually no driving catalysts from Canada this week, it’s not unexpected to see the Loonie closed mixed on Friday, driven mainly by counter currency flows and oil prices.

Canadian Headlines and Economic data

Monday:

No major news or catalysts from Canada on the session, but we did see a CAD move higher against the majors , with exception against the Kiwi and the Aussie. This was likely mainly driven by positive risk sentiment, likely supported by the overall themes of further covid stimulus and recovery expectations that has driven risk higher for a while now.

Tuesday:

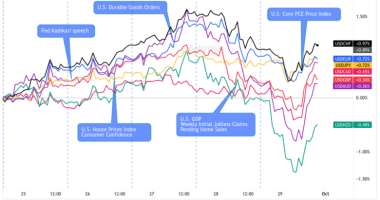

CAD took a dip on the session with no catalysts from Canada, which means it’s likely that U.S. dollar strength and falling oil prices were the likely the drivers for the Canadian dollar’s mixed and net lower move for the session.

Wednesday:

Bank of Canada accelerates work on digital currency amid pandemic -“A digital currency is by no means a foregone conclusion,” he said, later adding that Canada is front-runner among its peers on development, but behind countries like China, which has launched pilots of its offering.

Friday:

“Notwithstanding the 1.3% decline in December, sales for the month were still 3.0% higher than levels observed before the COVID-19 pandemic, with all 10 provinces recording higher sales than in February 2020. December sales were the third highest for the sector on record. Sales in five of the seven subsectors were higher than the pre-COVID-19 benchmark, led by building material and supplies (+12.2%), and machinery, equipment and supplies (+6.6%).”

Oil edges higher on U.S. stimulus hopes, tighter supplies

This post first appeared on babypips.com