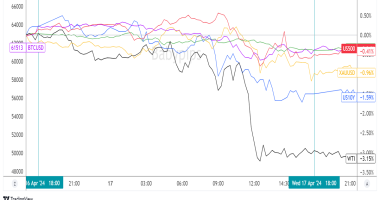

Most of the majors were in Rangeville during the Asian session though the Aussie and Kiwi found some support despite bearish sentiment from Australia and New Zealand.

Will we see more volatility during the London session?

Here are the headlines that you missed in the last couple of hours:

Upcoming Potential Catalysts on the Economic Calendar:

- Eurozone’s industrial production at 9:00 am GMT

- U.S. PPI reports at 12:30 pm GMT

What to Watch: GBP/NZD

GBP/NZD just broke below an ascending triangle after traders shrugged off negative interest rate speculations from the Reserve Bank of New Zealand (RBNZ) in favor of pricing in potential lockdown measures in the U.K.

Can the pair extend its downswing? Take note that the pound is sitting on the 1.9400 major psychological handle. What’s more, GBP/NZD has already fallen by 57 pips today. That’s around 35% of its 168-pip average daily volatility!

If you think that (1) a lack of progress on the Brexit negotiations and (2) continued speculations of increased lockdown measures in the U.K. will further weigh on Sterling, then you can short at current levels and then bail at the first signs of support or bullish pressure.

If you believe that the pair is already oversold, or that 1.9400 will hold as support, then you can also wait for a couple of bullish candlesticks and then aim for a potential retest of the broken triangle support.

This post first appeared on babypips.com