This consolidation breakdown on AUD/CAD hits the top of today’s watchlist as it could draw in technical traders for a potential swing position.

Before moving on, ICYMI, today’s Daily London Session Watchlist looked at an opportunity on GBP/USD’s recent trend, so be sure to check that out to see if there is still a potential play!

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 13102.74 -0.75% FTSE: 6323.81 -0.96% S&P 500: 3557.46 -0.29% NASDAQ: 11833.40 +0.27% |

US 10-YR: 0.86% -0.022 Bund 10-YR: -0.571% -0.016 UK 10-YR: 0.327% -0.012 JPN 10-YR: +0.013% -0.014 |

Oil: 41.58 -0.57% Gold: 1,860.20 -0.73% Bitcoin: 18,123.36 +2.49% Ethereum: 477.79 +0.44% |

Fresh Market Headlines & Economic Data:

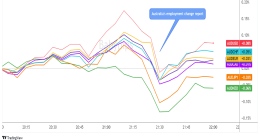

Dow futures extend losses following Wednesday’s sell-off

U.S. Jobless claims filings pick up amid continued struggles for labor market

Philly Fed manufacturing index decreased 6 points to 26.3 in November

U.S. existing home sales rise for fifth straight month

Employment in Canada decreased by 79,500 m/m in October – ADP

Euro area current account recorded €25B surplus in September 2020, up from €21B in August

EU holds off on no-deal Brexit plans amid last-ditch push for deal

Brexit Talks Suspended After Negotiator Catches Covid-19

U.K. Manufacturing demand slumps as activity remains weak – CBI

Swiss exports stagnated at – 0.4% and imports showed a decline of 3.3% in October

Upcoming Potential Catalysts on the Economic Calendar

Fed Mester speech at 5:00 pm GMT

Japan Inflation Rate at 11:30 pm GMT

Australia Retail Sales at 12:30 am GMT (Nov. 20)

Japan Manufacturing & Services PMI at 12:30 am GMT (Nov. 20)

What to Watch: AUD/CAD

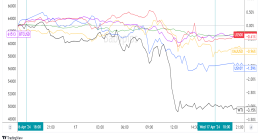

On the one hour chart above of AUD/CAD, we can see the pair recently broke below a rising wedge pattern, a classic technical setup that could draw in price action traders.

And with global risk sentiment likely leaning negative as traders focus on the renewed lock downs across Europe and the U.S. (and the likely negative effects on economic growth), odds are that the Australian dollar will underperform the Canadian dollar in this environment.

We also saw some support for the Canadian dollar earlier in the U.S. session, likely a reaction to the Canadian ADP employment update. While it did show a –79K jobs loss in October, this was way, way below the -1,489K average loss over the last 6 months and the -564K loss in September.

More volatility could come for the pair in the upcoming Asia session with the latest Australia Retail Sales data. If we see that data point come in below the previous read of -1.1%, more Aussie bearishness could be on the way. Also, if more lockdowns are announced in the U.S. or Europe, the shift in global risk sentiment towards negative could pick up speed, likely hurting the Aussie more than the Loonie.

Watch out for this scenario to play out, and if it does, look for a break and bearish patterns below 0.9500 before considering a short position. Or if the pair bounces ahead of Asia session, watch the 0.9550 area for bearish reversal patterns before considering a short if the above scenario plays out.

This setup could work for both medium and longer time frames, especially if we do see fresh news of a potential delay in oil supplies from OPEC. This will likely support oil prices, which tends to be supportive of the Canadian dollar.