NZD/CHF makes it to the top of the watchlist today as risk sentiment continues to trend positive ahead of potential catalyst from New Zealand.

Before moving on, ICYMI, today’s Daily London Session Watchlist looked at the uptrend in NZD/JPY, so be sure to check that out to see if there is still a potential play!

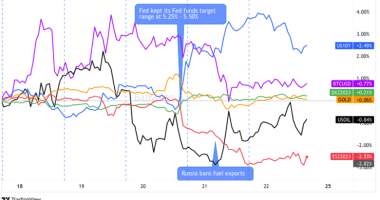

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14017.28 +0.61% FTSE: 6517.95 -0.10% S&P 500: 3917.16 +0.19% NASDAQ: 14024.21 +0.37% |

US 10-YR: 1.145% -0.007 Bund 10-YR: -0.465% -0.027 UK 10-YR: 0.457% -0.032 JPN 10-YR: 0.071% +0.08 |

Oil: 58.50 -0.31% Gold: 1,842.70 0.00% Bitcoin: 47,862.25 +6.69% Ethereum: 1,795.81 +4.12% |

Fresh Market Headlines & Economic Data:

Wall St. opens near record highs on stimulus hopes

Bitcoin blows past $48,000 to hit another record high as major financial firms warm to crypto

Bitcoin to Come to America’s Oldest Bank, BNY Mellon

Oil drops after strong rally as new COVID-19 variants weigh

U.S. weekly jobless claims edge down as labor market recovery stalls

German Wholesale prices in January 2021: 0.0% on January 2020

November 2020: German business insolvencies down 26.0% from November 2019

New Zealand electronic retail spending falls in January

Upcoming Potential Catalysts on the Economic Calendar

U.S. Budget Plan for Fiscal Year 2022 at 7:00 pm GMT

New Zealand Manufacturing Index at 9:30 pm GMT

New Zealand Food price index at 9:45 pm GMT

What to Watch: NZD/CHF

On the one hour chart of NZD/CHF, we can see that the recent dip in the uptrend may have bottomed out at the broken previous resistance area (around 0.6430 at the end of January), which also happens to line up with the Fibonacci retracement area of that swing move from roughly 0.6330 – 0.6500. Is it time for a new leg higher?

Well, with risk sentiment still leaning positive on stimulus hopes in the U.S., as well as vaccine hopes to end the pandemic, the odds are pretty good that the Kiwi will outperform once again in the short-term, barring any unseen market events. Plus, we’ve got minor economic events that could be catalysts for a push higher in the Kiwi if they come out positive.

So if you’re a bull on NZD/CHF, then consider going long at current levels, or scaling into a position at current levels. For the more conservative, look for a long entry if the market pulls back a bit as stochastic is signaling potentially short-term overbought conditions. This sets up for both a swing and longer-term position with good odds of success and R:R if the current environment holds.

If you’re a bear on NZD/CHF, it’ll likely take both a negative update from New Zealand on manufacturing sentiment and food prices, plus a negative turn in global risk sentiment for a short position to make sense short-term. If that scenario plays out, look for a break in the rising ‘lows’ pattern before considering a short position.