USD/JPY hits the top of the list today as the bearish push the pair lower quickly on the session. Will the momentum hold?

Before moving on, ICYMI, today’s Daily London Session Watchlist looked at an opportunity forming on AUD/JPY as it forms a downtrend, so be sure to check that out to see if there is still a potential play!

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 12162.98 +0.61% FTSE: 5823.60 +0.64% S&P 500: 3432.53 +1.88% NASDAQ: 11479.15 +2.85% |

US 10-YR: 0.77% -0.111 Bund 10-YR: -0.636% -0.016 UK 10-YR: 0.214% -0.059 JPN 10-YR: +0.038% -0.002 |

Oil: 37.95 +0.77% Gold: 1899.80 -0.55% Bitcoin: 13833.50 -1.22% Ethereum: 381.85 -1.46% |

Fresh Market Headlines & Economic Data:

With U.S. presidential election too close to call, Biden bats away Trump victory claim

U.S. Private payroll growth slows in October, well below expectations

ISM Services PMI: 56.6 in October vs. 57.8 in September.

Oil rises after Trump falsely claims victory in tight U.S. election

ECB likely to add new stimulus measures in December, ECB’s De Cos says

Eurozone services business activity contracts at a faster pace in October: 46.9 vs. 48.0 September

German Services activity slips back into contraction in October as second wave of coronavirus hits

UK Service sector recovery slows sharply during October

Upcoming Potential Catalysts on the Economic Calendar

New Zealand Business confidence at 12:00 am GMT (Nov. 5)

Australia Trade balance at 12:30 am GMT (Nov. 5)

Japan Services PMI at 12:30 am GMT (Nov. 5)

What to Watch: USD/JPY

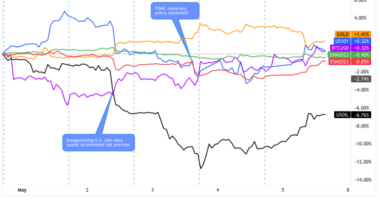

As we can see on the one hour chart above, USD/JPY volatility picked up nicely as the tally came in to see who would be the U.S President for the next term. After a pop higher to the major psychological level of 105.00, the bears took back control quickly as broad risk sentiment shifted negative after Trump claimed victory, probably a bit too early as many states were still counting votes. This brought the pair to the minor psychological level of 104.50, where we see previous support behavior, as well as a rising ‘lows’ pattern forming in the short-term.

With volatility for the U.S. Dollar likely to stay bid as we await the results of the U.S. Presidential election, USD/JPY should be a great opportunity for short-term pips going forward. But at the moment, the market is waiting figuring out where to go to next.

That’s pretty much an impossible task given the situation, which is why the likely best course of action is to watch USD/JPY for another pop in volatility and momentum move from current levels before acting, especially if it coincides with a more definitive election outcome (i.e., more states finish counting their votes or a winner is declared.)

That means a straddle play is the way to go for now, or for the more conservative trader types who want a fundamental catalyst confirmation, set up price alerts above and below the market, roughly 1/2 to 1 daily ATR (around 30 – 60 pips) to let you know when the price has moved meaningfully.

How ever the election ends up this week, and there are quite a few scenarios on how it can go, and it’s likely that which ever scenario we end up with, the result is likely to spur volatility, especially if the election is contested. Stay on your toes as always, but more so today as action could happen at any time and could happen fast.