The ECB is up this week! Not only that, but the Eurozone is printing a bunch of quarterly data that just might translate to one-directional trends.

Thinking of doing some euro trading?

Here are the potential catalysts you need to know about!

ECB’s policy announcement (Oct 29, 12:45 pm GMT)

- The European Central Bank (ECB) is expected to maintain its wait and see mode as major Eurozone economies implement localized lockdowns to control the second wave of COVID-19 infections

- Word around the hood is that ECB President Lagarde will hint at more easing in December to help ease growth concerns in the region

Q3 2020 preliminary GDP releases (Oct 30, London session)

- GDP readings from the Eurozone’s major economies will hint at how the economies have fared even before the planned lockdown measures amidst the second wave of infections

- Significant misses will NOT look good after last week’s PMI disappointments

- France’s growth (6:30 am GMT) could jump by 15.1% after a 13.8% decline in Q2

- Germany’s preliminary GDP (7:00 am GMT) could see a 7.2% uptick after a 9.7% decline

- Spain’s (8:00 am GMT) expected to grow by 13.5% after a 17.8% slump

- Eurozone (10:00 am GMT) to print a 7.5% growth after an 11.8% decrease in Q2

- Italy (11:00 am GMT) could see an 11.0% uptick after a 12.8% downturn

Potential catalysts for CHF

- Retail sales (Oct 30, 7:30 am GMT) to see an annual gain of 0.8% after a 1.9% dip in August

- KOF economic barometer (Oct 30, 8:00 am GMT) seen declining from 113.8 to 109.0

- The ECB’s event will likely have more impact than the economic releases so keep an eye on EUR/CHF

Technical snapshot

- Stochastic considers EUR/USD as “overbought”

- EUR/CHF is approaching “oversold” status on the daily time frame

- EMAs reflect EUR/CHF’s short and long-term bearish trends

- EUR/GBP, EUR/AUD, EUR/USD, and EUR/CAD are on short and long-term bullish trends

- Watch out for retracement or reversal opportunities on EUR/NZD and EUR/JPY

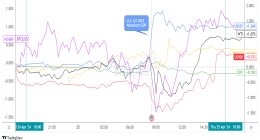

- The franc has gained value against its fellow safe-havens and the Loonie in the last seven days

- CHF lost the most ground against NZD

- The franc was most volatile against AUD, NZD, GBP, and JPY in the last seven days

This post first appeared on babypips.com