G’day forex mates! It’s time for yet another event preview as the Land Down Under gears up to release its jobs report for the month of October.

If you’re planning on trading this top-tier event or got some AUD positions open, let’s start prepping by reading up on what happened before, what’s expected, and how the Aussie might react.

What happened last time?

- September employment change: -29.5K vs. -38K consensus

- September unemployment rate unchanged at 6.9%

- August employment change upgraded from 111K to 129.1K

The September jobs report printed another headline surprise – its fourth monthly consecutive one – as hiring fell by only 29.5K versus the projected 38K drop.

It also saw the third month in positive revisions for earlier data, with the August report upgraded to show an impressive 129.1K rise in employment versus the originally reported 111K gain.

Although the September unemployment rate held steady at 6.9%, components of the report reflected a dip in labor force participation from 64.9% to 64.8%. This suggests that Australians are less confident in job market prospects.

Its also worth noting that underemployment climbed to 11.4% while the monthly hours worked rose by 9 million hours. In other words, employed folks are putting in more time at work but likely in positions that don’t fully utilize their skills or experience.

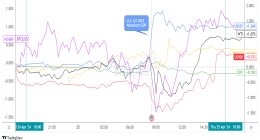

The Aussie was already drifting lower against most of its peers ahead of the release, and most pairs simply moved sideways upon seeing the actual numbers.

Later on, AUD pairs resumed their slide as risk aversion was in play throughout the trading sessions after seeing downbeat CPI readings from China.

What’s expected this time?

- October hiring to drop by 26.7K

- Unemployment rate likely increased from 6.9% to 7.1%

Another decline in hiring is expected for the previous month, although the drop might be smaller than the earlier 29.5K figure. If the latest results are any indication, there appears to be a good chance for an upside surprise or positive revisions in the earlier report.

Leading indicators from have a few more clues:

In summary, leading indicators are reflecting a rebound in business activity, likely trickling into stronger hiring conditions for the month.

However, this pickup in sales and new orders may take some time before fully impacting overall employment, probably just resulting in even more hours worked for the month instead.

Also keep in mind that the RBA talked about prolonged weakness in the jobs sector, so they might not be expecting such a big recovery anytime soon.

One thing to always remember when trying to trade this report is that AUD pairs might be prone to a knee-jerk reaction to the headline readings, only to reverse (or maybe sustain) those moves as traders dig deeper into the underlying data.

Don’t forget to check out the revisions to previous numbers, and the participation rate for a better understanding of the employment situation.

This post first appeared on babypips.com