Ford will go all electric in Europe by 20230, the automaker announced Wednesday, joining a growing list of manufacturers planning to shift away from conventional internal combustion engines.

The announcement comes just weeks after Ford said it would double its investment in electric powertrains and vehicles to $22 billion by 2025. That will include the $1 billion the company will spend on a new EV manufacturing center in Cologne, Germany.

“We successfully restructured Ford of Europe and returned to profitability in the fourth quarter of 2020,” Stuart Rowley, president of European operations, said during a Wednesday news conference. “Now we are charging into an all-electric future in Europe with expressive new vehicles and a world-class connected customer experience.”

Ford joins an expanding number of manufacturers turning their focus to battery-powered vehicles. On Monday, British-based Jaguar Land Rover said the Jaguar brand will offer only pure battery-electric vehicles, or BEVs, by 2026. Bentley, Nissan, Volvo and General Motors have already committed to going 100 percent electric, in one form or another.

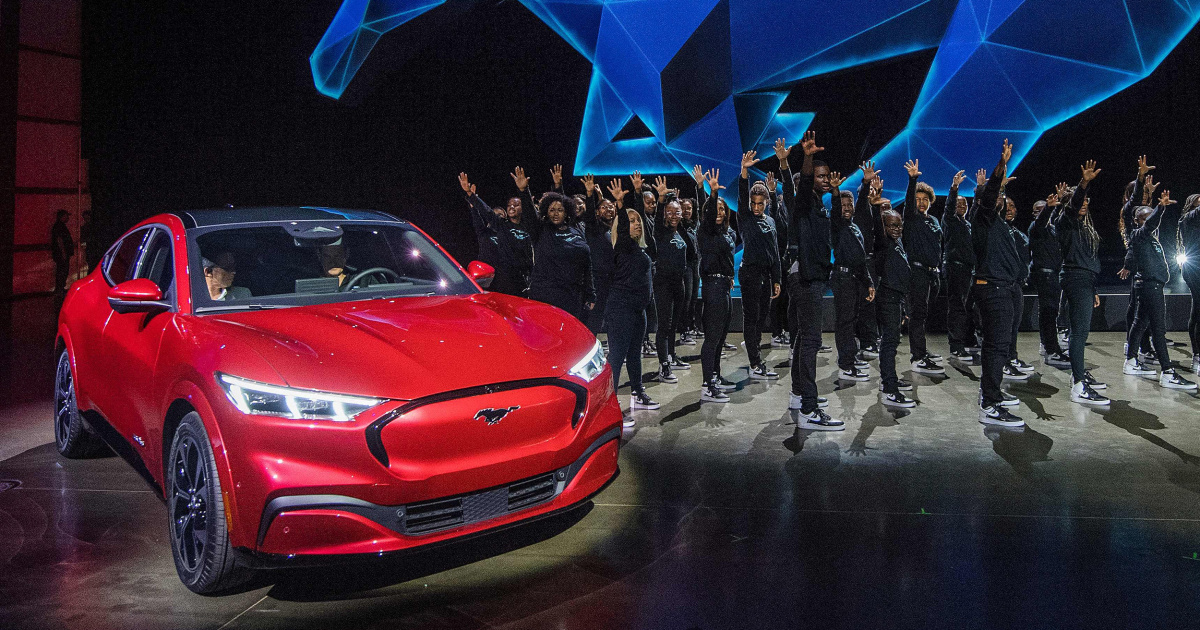

For its part, Ford will opt for a mixed approach, made up of both BEVs and plug-in hybrid electric vehicles, or PHEVs. It currently offers a handful of each, including the long-range Ford Mustang Mach-E battery-car and the plug-in Lincoln Aviator Touring.

Ford said Wednesday that it expects to have the first all-electric model designed specifically for European customers to roll out of the new Cologne facility in 2023.

Ford expects to have the first all-electric model designed specifically for European customers to roll out in 2023.

The project “underlines our commitment to Europe and a modern future with electric vehicles at the heart of our strategy for growth,” Rowley said. Ford currently holds a 15 percent share of the European market.

It also reflects the reality that all automakers face in Europe where regulators have begun enacting increasingly stiff CO2 emissions mandates that could result in billions of dollars in fines for manufacturers missing their targets. When announcing its own EV plans this week, Jaguar Land Rover said it set aside 35 million pounds, or $48.7 million, to cover fines for missing EU emissions targets last year.

Hybrids and all-electric powertrains — as well as hydrogen fuel-cells — are generally seen as the only way to meet the latest emissions standards, according to industry analysts.

And even tougher mandates are coming. British regulators recently moved to speed up their own rules and now will ban the sale of vehicles using only gas or diesel power by 2030, with even hybrids banned by 2035.

Other European countries, including Norway, France and Germany, either have enacted, or are studying, similar rules. A number of cities are also planning similar steps. Paris is set to ban diesel vehicles from even entering the city, after numerous problems with smog in recent years.

Europe has been embracing electrification more quickly than many other markets. While BEVs accounted for barely 2 percent of U.S. new vehicle sales in 2020, they reached 4.5 percent in Europe, according to industry data, with PHEVs coming in at about the same level, 4.7 percent. In Norway, meanwhile, sales of pure electric models have reached as high as 75 percent in some recent months, albeit with hefty financial incentives.

Ford’s move to electrify its European operations will put it in a chase for dominance. The market leadership has been bouncing back and forth between various manufacturers over the last two years, with Volkswagen lately topping sales charts with the launch of its first long-range model, the ID.3. California-based Tesla is aiming to regain its king-of-the-hill status with the upcoming opening of its first European plant in Berlin sometime late this year.

Source: | This article originally belongs to Nbcnews.com