Sterling was pushed around by counter currency flows last week, but can it find some direction this time with the jobs report coming up?

Here’s what market watchers are expecting:

U.K. jobs report

- December claimant count change to show 40K increase in joblessness

- Average earnings index to rise from 2.7% to 3.0% for three-month period ending in November

- Unemployment rate to rise from 4.9% to 5.1% in November

- Weaker than expected results would confirm that the U.K. was hit harder by the latest round of tighter lockdown restrictions and Brexit uncertainty

- Note that last week’s flash PMI readings came in way below expectations, reflecting the sharpest rate of contraction since May last year and a drop in employment activity

Technical snapshot

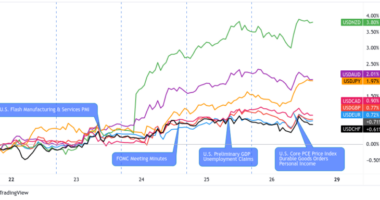

- Stochastic suggests that most sterling pairs are in for declines, with GBP/CHF and GBP/NZD also inching towards bearish territory

- EUR/GBP is seeing oversold conditions based on this indicator

- The pound has been most volatile against the Loonie and Kiwi in the past week, moving an average of 109.5 pips per day, followed by the Aussie at 96.2 pips

Missed last week’s price action? Check out the GBP Price Review for Jan. 18 – 22!

This post first appeared on babypips.com