Sterling was off to a weak start for the year, as Brexit and a new wave of lockdown measures weighed on the British currency.

Can it recover this week?

A couple of BOE monetary policy committee members are due to testify early on, then the monthly GDP and industrial production figures are before the end of the week.

MPC members’ speeches

- BOE official Silvana Tenreyro is scheduled to speak about the international evidence of the transmission of negative interest rates at an online event on Jan. 11, 3:00 pm GMT

- BOE Deputy Governor Ben Broadbent is due to deliver a speech titled “COVID and the Composition of Spending” at an online event on Jan. 12, 11:00 am GMT

- Hints that the central bank is open to lowering interest rates further could drag sterling south, along with downbeat remarks on spending and overall growth on account of the lockdown measures

Mid-tier economic data (Jan. 15, 8:00 am GMT)

- Construction output likely increased 0.8% in November after earlier 1.0% gain

- Monthly GDP probably contracted 4.6% in November after five consecutive months of growth

- Goods trade deficit probably shrank from 12.0 billion GBP to 11.1 billion GBP

- Industrial production likely posted 0.5% uptick in November after earlier 1.3% gain

Technical snapshot

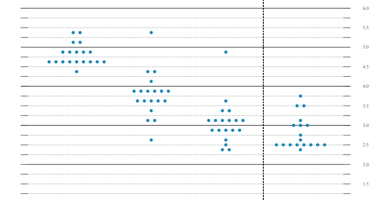

- Stochastic paints a mixed picture of pound pairs, with GBP/AUD in the oversold region and GBP/JPY in the overbought zone

- The rest of the GBP pairs are in neutral territory

- Price action over the last seven days shows that sterling has been most volatile against the Kiwi, as GBP/NZD moved an average of 136.3 pips per day

Missed last week’s price action? Check out the GBP Price Review for Jan. 4 – 8!