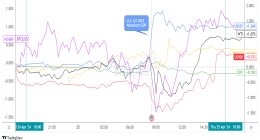

The British pound was the biggest loser of the week as the odds of a no-deal Brexit elevated with each passing day and rhetoric signaling that a compromise was out of reach between the U.K. and EU.

United Kingdom Headlines and Economic data

Monday:

UK public’s £100bn Covid savings could help recovery, says Haldane – “He said the UK savings ratio, which measures how much of disposal incomes is set aside, rose to 29% between April and June, compared with 6.8% in the same period last year. The ratio is more than twice as high as the previous record of 14.4%, set almost three decades ago.”

Breakthrough on fishing rights as Brexit talks hang in the balance – “Sources in Brussels said the two sides had all but finalised terms on the level of access for EU boats to seas within the UK’s 200-mile exclusive economic zone, with a transition period for phasing in changes understood to be between five and seven years.”

Michel Barnier offers downbeat take on Brexit talks to diplomats and MEPs and said that Brexit talks will not go beyond Wednesday – This rhetoric and speculation that talks could collapse in next few hours that was the likely catalyst for Sterling’s broad move lower during the London trading session.

UK house prices show biggest annual rise since 2016 – Halifax – Halifax said house prices rose by 1.2% on the month in November alone, and that they had risen by 6.5% over the past five months, the biggest rise since 2004.

UK’s Johnson to head to Brussels amid Brexit talks deadlock

Tuesday:

No substantial progress in Brexit trade talks, Germany’s Roth says

As deadline nears, Johnson says Britain could abandon Brexit trade talks

UK drops treaty break threats after deal on EU divorce accord implementation

UK and EU reach agreement on Northern Ireland border issues

Wednesday:

Johnson Says No U.K. Leader Could Accept EU Terms: Brexit Update

UK PM Johnson warns EU over Brexit trade talks: back down or it’s no-deal – “Johnson did not “want to leave any route to a possible deal untested” after the premier earlier in the day warned the EU to budge or brace for the most-damaging split on Dec. 31 as Britain completes its transition out of the bloc.”

EU’s McGuinness says Commission preparing no deal Brexit plans – “I’m not very confident from the speech made by the British prime minister in the House of Commons today. I think there is a failure to understand, which perhaps is a failure of Brexit at the very outset, if you choose to leave, there are consequences, particularly where that country wants to stay part of the single market,” she added on the chances of a trade deal.

Thursday:

UK GDP growth slows to six-month low as COVID hits hospitality

“Gross domestic product rose 0.4% in October after expanding 1.1% in September.”

“Britain has Europe’s highest death toll from COVID-19, with more than 62,000 fatalities. “

UK and EU extend Brexit talks to Sunday – “After in-person discussions in Brussels that lasted hours, both sides said Wednesday evening that they remained far apart on key issues and a decision on the future of the talks would be made by the end of this weekend.”

No-Deal Brexit More Likely After Dinner Fails, Officials Say

U.K. Housing Market Loses Momentum With Unemployment on the Rise

U.K. manufacturing rose by 1.7% m/m in October

Production output rose by 1.3% m/m

For the three months to October 2020, compared with the three months to October 2019, production output decreased by 6.1%; this was led by a fall in manufacturing of 7.8%.

Friday:

UK’s Johnson says ‘strong possibility’ of no-deal split in EU trading ties – “We need to be very, very clear there’s now a strong possibility, strong possibility that we will have a solution that’s much more like an Australian relationship with the EU, than a Canadian relationship with the EU,” Johnson said.

Bank of England readies armory to deal with any Brexit disruption – Governor Andrew Bailey said the central bank had done all it could to mitigate risks from a no-deal departure from the EU on Dec. 31, and it was ready to deal with any disruptions to financial markets.

Bank of England says UK banks can withstand COVID-19 and Brexit

Bank of England warns of market instability and financial disruption

This post first appeared on babypips.com