The British pound was able to stage a late rally and close the week net green on optimism the U.K. will exit lockdown as pandemic cases ebb.

United Kingdom Headlines and Economic data

Tuesday:

U.K. Retail sales fall as new variant of virus spooks consumers

“The findings are certain to intensify pressure on Chancellor of the Exchequer Rishi Sunak to use his budget on March 3 to extend tax relief programs designed to help struggling shops and other businesses through the pandemic.”

Wednesday:

Brexit threatens to spoil U.K. hospitality’s post-covid recovery

“From April, the U.K. will start imposing new controls on food and drink coming from the European Union, the source of about a third of the country’s supply. The prospect is causing concern among executives, who fear any delays or disruption will leave them struggling to meet demand from consumers.”

BOE’s Bailey says U.K. won’t slash regulation after Brexit

Thursday:

U.K. house prices rise in January despite buyers staying away

“Real-estate agents reported continuing demand from people seeking to beat the March 31 expiry of a homebuying tax cut worth as much as 15,000 pounds ($21,000).”

Friday:

BOE’s Haldane predicts possible double-digit annual growth rate in UK a year ahead

U.K. Economy Caps Worst Year Since 1709 With a Surprising Surge

“Gross domestic product grew 1% in from October through December, fueled by a boom in construction and government spending.”

The total trade deficit for December 2020, excluding non-monetary gold and other precious metals, widened by £0.3B to £5.6B – “imports increased by £0.8B and exports increased by £0.4B.”

BOE imposes tougher rule on banks in first post-Brexit proposal

“The central bank’s Prudential Regulation Authority said it won’t allow lenders in the country to get a capital benefit from their investments in software technology. The decision contrasts with a move by the European Union last year to allow its lenders, including Deutsche Bank AG, to get a break on capital worth up to 20 billion euros ($24 billion)”

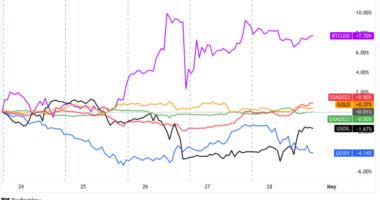

Virus in Reverse Across U.K. as Johnson Plots Lockdown Exit – This headline was likely the catalyst for Sterling’s broad move higher on the session to help it close net positive on the week against the other major currencies.