WORKERS who lose their jobs can actually add up to £29,330 to their retirement funds.

As the cost of living crisis continues and businesses continue to axe jobs, lots more redundancies are sadly on the cards.

While job loss can be devastating, if you’re able to find new work pretty quickly, you could put your redundancy cash to good use.

Workers putting a redundancy paycheck into their pension could be £10,000s better off when they retire, according to Becky O’Connor, director of public affairs at pension platform PensionBee.

Adding the cash to a pension can result in a gain of 47% for a typical worker, their analysis found.

Becky said: “While you might need to use redundancy money to tide you over until you find more work, or to retirement, depending on your age, if you’re lucky enough to get another job quite quickly, this cash is tantamount to a windfall.

READ MORE IN MONEY

“One of the most tax-efficient and generally financially beneficial things you can do with it is add it to your pension.”

She added that if you are approaching 55, the age at which you can first access your workplace pension, this can make even more sense.

That’s because you’re very close to being able to use that money anyway, but with the benefit of tax relief and hopefully some investment growth on top, too.

You are automatically signed up to your workplace pension scheme through your job if you’re over 22.

Most read in Money

This is separate to the State Pension and money is deducted from your pay unless you opt out.

A minimum of 8% goes into the pension – you contribute 5% and your employer pay at least 3%.

But you can pay in more than the minimum, and making the sacrifice today means in the future when you leave work your annual income from your pot will be higher.

The first £30,000 of a statutory redundancy payment is tax-free.

Employers are required to pay at least statutory redundancy after you’ve worked there for two years.

Statutory redundancy is one week’s pay per year of service.

Although often employers will pay more than just statutory as part of a compensation package.

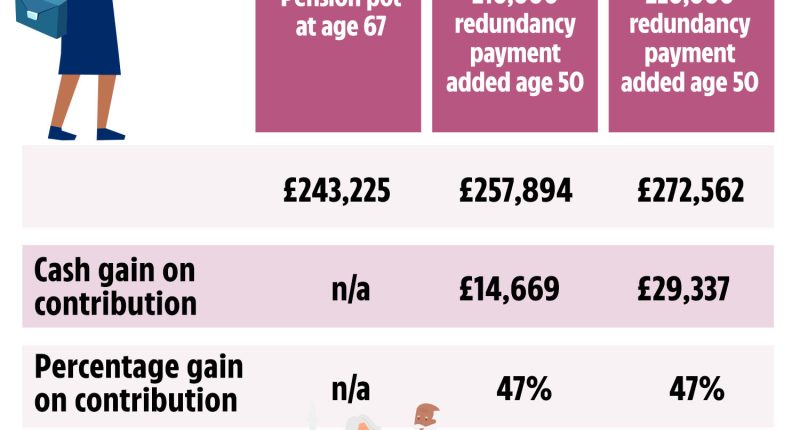

The experts crunched the numbers to see exactly how much adding a redundancy payment to your pot could be depending on a person’s age.

PensionBee’s research showed if a 50-year-old added a £10,000 redundancy payment to a pension, it could increase the average pot by £14,669 by age 67, to £257,894.

If someone adds £20,000 at age 50, by 67 their pension pot would be worth £272,562 – that’s a whopping £29,337 more.

It’s worth noting that these examples assume a £105,000 pot size by age 50, as well 1% salary growth a year, 3% investment growth (after inflation), 0.7% fee, and 8% overall contributions.

By putting extra money in your pension, it’s not just your money you’re saving – you benefit from tax relief and investment growth over the years.

Tax relief means when you pay £80 into your pension, the government tops it up to £100, instead of taking the 20% tax on it.

Becky added that the majority of employers will add your redundancy payment directly to your pension if requested.

She also pointed out that paying a redundancy payment into your pension can help you avoid going into a higher tax bracket as well as boosting your retirement savings.

More tips too boost your pension if you lose your job

Becky has shared further tips for how to boost your pension if you lose your job.

She said: “Firstly, don’t panic. When you lose your job your workplace pension still belongs to you.

“While your old employer will stop paying into it, your pension will still be managed by your pension provider and should continue to grow over the long term.”

According to Becky, it’s important to remember that workplace pensions aren’t the only option available to you.

That’s because you can save into a private pension even if you’re not in employment.

She said: “It’s worth considering combining your old workplace pensions together into one pension plan, where it makes sense, to give you a holistic view of your savings and help you assess if you’re on track for your desired retirement.”

When applying for new jobs, you should consider the prospective employers’ workplace pension scheme.

Defined contribution schemes offer a minimum total contribution, including the employee’s, of 8% under auto-enrolment, but can be higher.

The amount employers pay in can vary from the minimum requirement of 3% to well into double figures, which can make thousands of pounds difference to you when you retire.

“Double matching”, which is when you increase what you put in and the employer doubles up on your contributions, can be a good idea too.

Becky said: “Work out how much of your redundancy payout attracts tax relief before deciding how much to contribute.

“Only the part of the redundancy payment over the tax-exempt threshold of £30,000 counts as relevant UK earnings and can therefore attract tax relief, as well as the part of the payment that comes from salary, bonuses or holiday.”

This is in addition to other UK relevant earnings, so can add up, she added.

Read More on The Sun

Meanwhile, Becky has also revealed her secret for boosting your retirement pot by up to £128,000.

Plus, there are some changes coming up to auto-enrolment rules.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.