Positive risk sentiment tanked the safe-haven yen last week. Check out this week’s potential catalysts to see if the bulls can sneak in a pip or two in the next few days!

Here’s a short list for ya:

Domestic economic reports

- Annualized bank lending (Jan 11, 11:50 pm GMT) to slow down from 6.3% to 6.1%

- Economy Watchers sentiment (Jan 2, 5:00 am GMT) seen dipping from 45.6 to 45.0

- Preliminary machine tool orders (Jan 13, 6:00 am GMT) to jump from 8.0% to 12.5%?

- Core machinery orders (Jan 13, 11:50 pm GMT) could plummet from 17.1% to -7.0% in November

- Annual producer prices (Jan 13, 11:50 pm GMT) to print at -2.1% after -2.2% reading in November

Safe-haven demand

- The U.S. dollar may have gotten some reprieve in the past few days, but USD/JPY’s longer-term downtrend remains intact

- Stimulus prospects in the U.S. and more vaccinations around the world can continue to boost higher-yielding bets against safe-havens like the yen

- Political uncertainty in the U.S. and lockdown plans from the major economies can weigh on risk-taking and boost the safe-havens

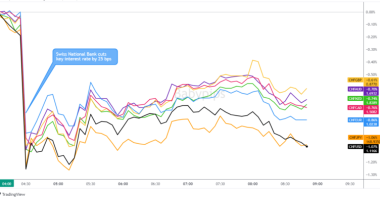

Technical snapshot

Watch the major yen crosses, which look like they’re hitting technical resistance levels

- Stochastic is flagging the yen’s “oversold” conditions against the comdolls and the pound

- JPY is also approaching oversold levels against EUR, USD, and CHF on the daily time frame

- EMAs show the yen’s short and long-term bearish trends against CAD and GBP

- JPY is seeing short-term demand against AUD, NZD, and CHF

- The yen was most volatile against the comdolls and the dollar in the last seven days

Missed last week’s price action? Read JPY’s price recap for Jan. 4 – 8!