Can this week’s BOJ decision and Japan’s data releases extend the yen’s uptrend from last week?

If you’re planning on trading the safe-haven yen, then ya better read up on what markets are expecting from this week’s potential catalysts!

Here are some points that might help you out:

BOJ’s policy decision (Jan 21, Asian session)

- Market players don’t see the Bank of Japan (BOJ) announcing fresh stimulus this week

- The central bank is also expected to maintain its negative rate and yield curve control policies

- The biggest headlines will probably be about BOJ scaling down its ETF purchases because “stocks only go up” these days

- BOJ Governor Kuroda is giving a presser after the official statement is released

Lower-tier data releases

- Trade surplus (Jan 20, 11:50 pm GMT) to balloon from 367B JPY to 800B JPY in December as exports outpace imports

- National core CPI (Jan 21, 11:30 pm GMT) seen dipping by 1.1% after a 0.9% drop in November

- Markit’s flash manufacturing (Jan 22, 12:30 am GMT) expected to inch higher from 50.0 to 50.9

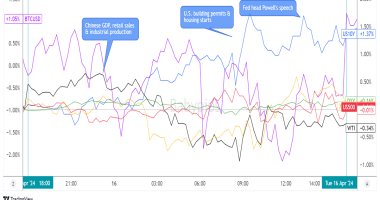

Market risk appetite

- Eyes will be on USD/JPY and how it responds to the U.S. yield curve. Biden’s inauguration and earnings reports in the U.S. can influence its intraweek trends and affect the rest of the yen crosses

- Lockdown and recovery concerns around the world will continue to affect JPY’s price action

- Policy decisions by the Bank of Canada (BOC) and European Central Bank (ECB), as well as PMI releases from the U.S., U.K., Eurozone, and Australia, can also influence the demand for the safe-haven yen

Technical snapshot

- Stochastic is reflecting JPY’s overbought conditions against EUR and CHF

- JPY may soon hit oversold levels against AUD, CAD, and GBP on the daily time frame

- Daily SMAs reflect a short-term demand for the yen across the board

- Watch out for retracement or reversal opportunities on USD/JPY, NZD/JPY, EUR/JPY, and CHF/JPY

- The yen saw the most volatility against the comdolls and the pound in the last seven days

Missed last week’s price action? Read JPY’s price recap for Jan. 11 – 15!