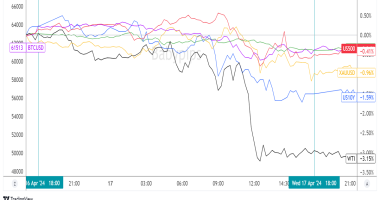

The Japanese yen closed the week as a net loser, likely driven lower by counter currency strength s rising interest rates around the world turned traders against this low-yielding currency.

It’s also likely improving economic data from Japan and the news of more ETF buying by the Bank of Japan had traders moving away from the yen as well.

Japanese Headlines and Economic data

Monday:

Japan Services PPI for January: -0.5% vs. -0.3% in December

Tuesday:

Govt. to discuss lifting state of emergency

“The governors of Osaka, Hyogo and Kyoto plan to ask the central government to end the state of emergency early in their prefectures.”

“Meanwhile, Aichi Prefecture Governor Ohmura Hideaki has begun discussions with officials from neighboring Gifu Prefecture to see if it is possible to lift the state of emergency by the end of this month.”

Wednesday:

Japan’s Aso says must keep issuing deficit-covering bonds until 2025

“It’s true Japan has been able to issue massive bonds stably at low cost. Markets are calm now, but there is no guarantee it will stay that way in the future,” Aso told parliament.

Thursday:

Japan government to end state of emergency in five prefectures at end of month

“Osaka, Kyoto, Hyogo, Aichi and Gifu prefectures will all have their emergency coronavirus pandemic measures lifted, Kyodo cited government sources as saying.”

Global government bonds hit by fresh wave of selling

“US 10-year Treasury yield jumps above 1.4% for first time since start of Covid crisis”

Friday:

Tokyo core CPI fell 0.3% vs. projected 0.4% drop

Japanese preliminary industrial production up 4.2% vs. 3.9% forecast

“Industrial Production is picking up.”

“Production, Shipments increased, Inventories, Inventory Ratio decreased.”

“According to the Survey of Production Forecast in Manufacturing, Production is expected to increase in February, decrease in March.”

Japanese retail sales fell 2.4% vs. expected 2.6% slump

Bank of Japan buys ETFs for first time this month after market rout

“The BOJ bought 5 million yen ($47,068) worth of ETFs on Friday, central bank data showed.”

“Some analysts saw the BOJ’s moves in February as a prelude to what may come out of a March review of its policy tools to make its asset-buying programme more nimble.”