With no economic data due from New Zealand, Kiwi traders will take their cues from the comdoll’s major counterparts.

Which potential catalysts should you be looking at?

Here’s a list!

Market moving events from other economies

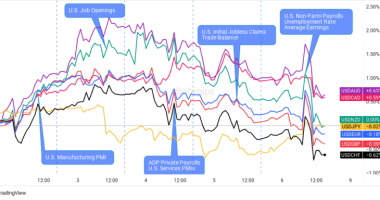

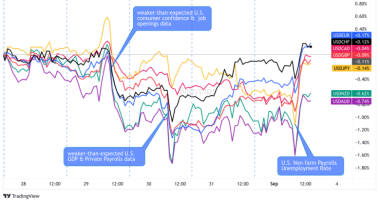

- PMI reports from China, U.S., and the Eurozone would hint at the pace of global economic recovery

- Lower-tier data from Australia (job ads, trade balance), one of New Zealand’s largest trading partners, can influence NZD’s intraday volatility

- NFP-related news in the U.S. can cause intraday spikes for NZD/USD and NZD/JPY

Overall risk sentiment

- Start-of-year optimism could boost high-yielding bets like the Kiwi

- Vaccine-related updates can also support risk-taking in the next few days

- Results of Georgia’s Senate runoff elections can dominate the newswires during the week

- Major dollar pairs will also move around on January 6 when the U.S. Congress is expected to cement Joe Biden’s presidency

Technical snapshot

- RSI considers NZD/USD as “overbought” on the daily time frame

- Kiwi is approaching “oversold” levels against the Aussie

- NZD remains in neutral territory against GBP

- Daily SMAs show the Kiwi’s short and long-term bearish trends against the Aussie

- NZD remains in bullish trends against the USD, CHF, and EUR

- NZD is seeing short-term weaknesses against CAD, JPY, and GBP

- NZD was most volatile against GBP and the safe-havens in December

This post first appeared on babypips.com