New Zealand is in for a quiet data release week, which means that Kiwi traders could take cues from risk sentiment and countercurrency trends.

Which potential catalysts should you watch out for?

I have a short list!

Lowe-tier local releases

- Building consents (Mar 2, 9:45 pm GMT) seen dipping by 2.6% after a 4.9% uptick in December

- Reserve Bank of New Zealand (RBNZ) Orr will talk monetary policy at a forum on Mar 3, 8:15 pm GMT. Look for signs of tapering now that the central bank added housing considerations in its policy decisions

AUD and CNY catalysts

- Australia and China are two of New Zealand’s largest trading partners, so top-tier news from their economies can impact NZD’s price action

- China’s manufacturing PMI expands at a slower pace in Feb

- Reserve Bank of Australia (RBA) will likely emphasize its commitment to keep longer-term yields low in its policy statement on Mar 2 at 3:30 am GMT

- Australia’s quarterly GDP (Mar 3, 12:30 am GMT) is expected to slow down to 2.2% in Q4 2020

- The U.S. NFP (Mar 5, 1:30 pm GMT) is expected to rebound after a net increase in January

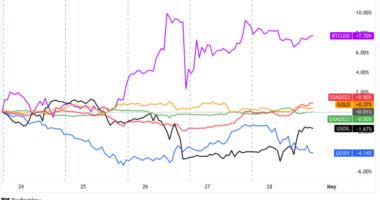

Market risk sentiment

- Bond yields will continue to be under the spotlight as traders focus on the pace of global economic recovery. Central banks that focus on containing yields will likely see weaker local currencies

- Start-of-month risk-taking can offset some of the selloffs in higher-yielding bets last week

- Optimism over the global economic recovery might limit the losses of comdolls like the Kiwi

Technical snapshot

- NZD is seeing short-term selling pressure on the daily time frame

- NZD is still bearish against GBP though it remains above the 200 SMA on the daily

- NZD was most volatile against the safe-havens and the euro in the last seven days

Missed last week’s price action? Read NZD’s price recap for Feb. 22 – 26!