Howden Joinery Group shares soared on Thursday morning after the kitchen materials supplier noted ‘encouraging’ revenue growth so far this year.

The London-based company’s shares were 8.9 per cent higher at 841.2p by midday, making them the second-biggest FTSE 250 riser behind power generation business Drax Group.

It revealed that revenues had increased across all countries where it operates when measured against the equivalent time in 2023.

Howden;s shares were the second-biggest FTSE 250 riser behind power generation business Drax Group.

Howden’s turnover flatlined at £2.31billion last year due to declining demand at UK depots as cost-of-living pressures and higher interest rates discouraged more Britons from making property renovations.

Operating profits also slumped by £75million to £340.2million following a jump in build inflation costs, and investment towards opening new depots and improving warehousing and transport schemes.

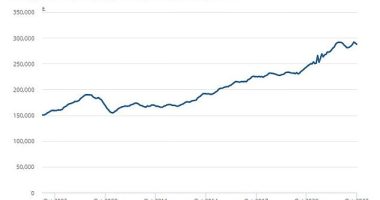

Nonetheless, the firm’s total revenues and operating profits remained far above pre-pandemic levels, with the former up 45.9 per cent and the latter around 31 per cent higher than in 2019.

Howden received a significant boost from the lockdown era, which led to a DIY boom.

Record-low mortgage rates, a temporary stamp duty holiday and a desire for more space further bolstered the home improvement sector at the time.

Sales expansion has inevitably slowed across the industry since the end of Covid-related curbs drove people to spend more time outdoors and work less often from home.

But Howden has continued to enlarge its depot network, opening 33 in the UK and ten across France and the Republic of Ireland last year.

As part of its target to have 1,000 depots, the company intends to launch 40 more sites and reformat another 85 in the UK during 2024.

Andrew Livingston, its chief executive, said: ‘Our robust balance sheet underpins our strategy as we invest in growth, including expanding our manufacturing and supply chain capabilities, and returning surplus capital to shareholders.

‘While we are cautious about the macro-economic and geo-political environment, given the encouraging start to the year and the agility of our business model, the board is confident in the outlook for 2024.’

Livingston succeeded Howden founder Matthew Ingle in 2018 following a period in charge at Kingfisher subsidiary Screwfix Direct and time at B&Q and Wyevale Garden Centres.