Start your trading prep with a review of last week’s price action and an overview of catalysts coming up.

Take a look at how the majors performed recently and the upcoming catalysts to watch out for:

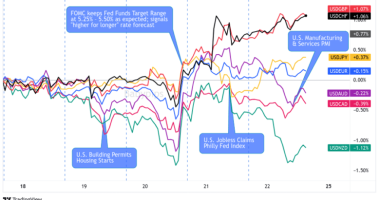

Major FX Pairs Overview

USD

The Greenback already had a weak showing for the most part of the week, so it managed to shrug off the downside NFP surprise later on.

The focus shifts to inflation this time, as Uncle Sam gears up to print PPI and CPI readings. Of course overall market sentiment would likely push USD pairs around, too. Read more.

CAD

It was a mixed start for the Loonie, but it wound up as the top performer of the week when crude oil rallied on the OPEC+ decision.

The BOC will be announcing its monetary policy decision early this week, but no actual changes to interest rates are expected. Will the central bank sound more optimistic? Read more.

EUR & CHF

Both the euro and franc chalked up a net positive week as counter currency flows and risk sentiment were the main drivers, along with somewhat upbeat eurozone data.

The ECB decision is coming up, and market participants are counting on an expansion of the PEPP program even with no changes to interest rates. Read more.

GBP

Hopes for a Brexit deal continued to keep sterling afloat in the previous week since there were no other major U.K. reports released.

Pound pairs were off to a shaky start this time, though, as officials were still unable to reach an agreement over the weekend. The lack of top-tier catalysts could keep traders focused on Brexit developments. Read more.

JPY

The yen closed the week in the red, even with improving data from Japan, as risk appetite stemming from stimulus hopes was in play.

There are no major reports due from Japan this week, so yen traders could keep taking cues from sentiment and counter currency action. Read more.

AUD

It was a mixed run for the Aussie as it tossed and turned on major headlines, as well as the RBA minutes and economic data.

It’s a quiet week for the Aussie, at least in terms of economic releases, so market sentiment might be the main driver of price action. Read more.

NZD

The Kiwi was unable to hold on to early gains from upbeat New Zealand data, as risk-taking took a hit later on.

There are no major catalysts to take cues from this week, so the Kiwi might get pushed around by sentiment and counter currency flows. Read more.

Forex Charts to Watch:

EUR/GBP: 1-hour

First up is this break-and-retest setup that’s already playing out on EUR/GBP’s 1-hour chart.

The pair already bounced off the area of interest around .8975 and is now setting its sights on the bullish targets marked by the Fib extension tool.

Price is closing in on the first ceiling at the 38.2% level or .9066, but stronger buying pressure could take it up to the 50% level near the .9100 handle. This is also in line with the swing high that’s a strong take-profit point.

Technical indicators confirm that bulls still have the upper hand, as the 100 SMA is above the 200 SMA while Stochastic is moving north.

EUR/USD: 4-hour

Now this one is a correction play that’s just about to unfold!

EUR/USD is stalling at the 1.1283 mark after breaking above the strong resistance at the 1.1900 major psychological level. A pullback to the Fibonacci retracement levels might draw more buyers in.

In particular, bulls could be hanging out around the 50% level at 1.1850 or the 38.2% Fib at 1.1962. Stochastic is starting to turn lower to signal that a retracement is in order, but the 100 SMA is above the 200 SMA to suggest that support levels are likely to hold.

GBP/JPY: 1-hour

Guppy has formed higher lows and slightly higher highs to consolidate inside a rising wedge on its short-term time frame. Think a breakout could take place soon?

The consolidation is getting tighter and tighter, so the pair could be in for a big move in either direction. Technical indicators are giving mixed signals, with the 100 SMA above the 200 SMA and Stochastic starting to turn lower.

In any case, a breakout could be followed by a rally or drop of the same height as the chart pattern.

This post first appeared on babypips.com