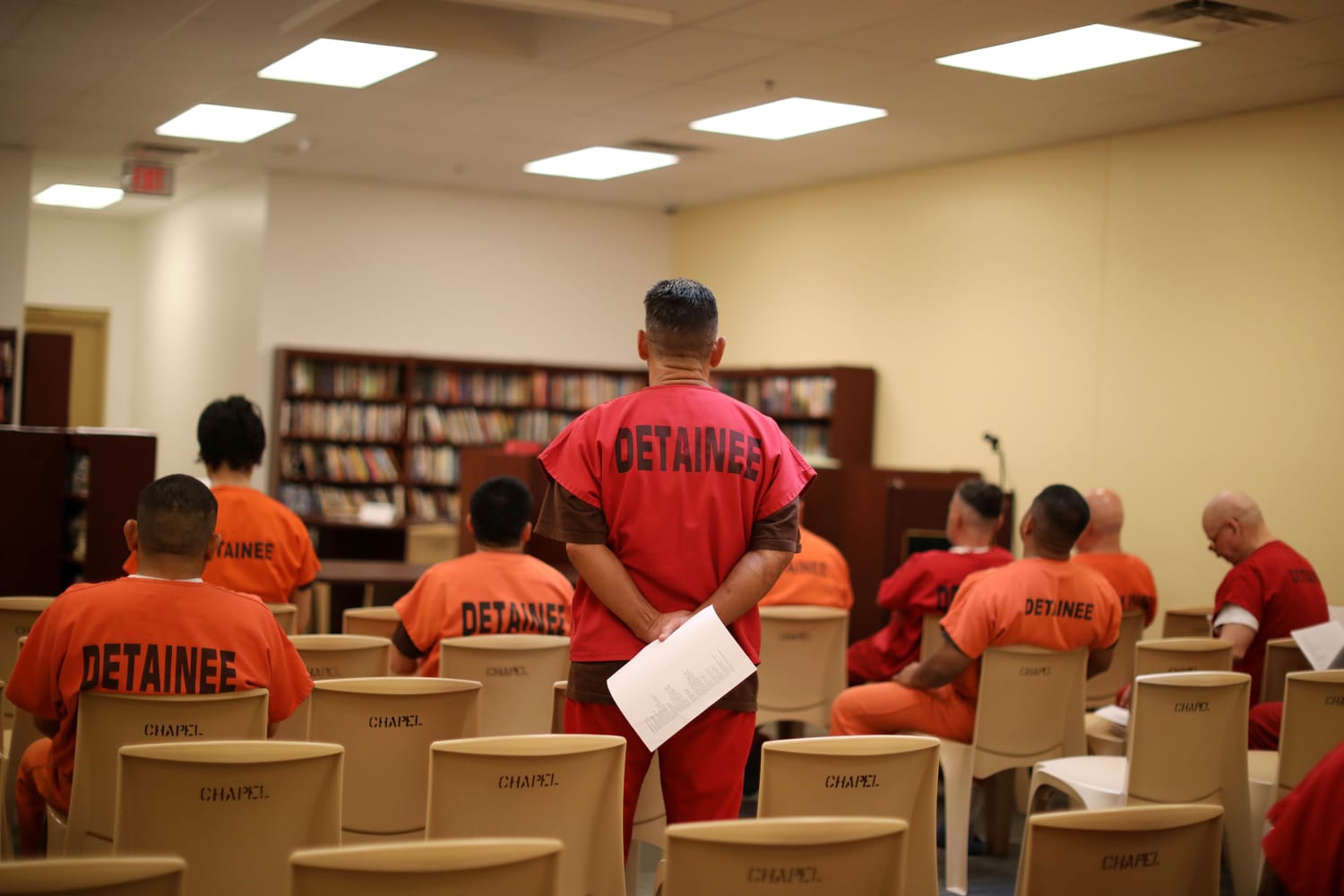

WASHINGTON, Feb 22 – The U.S. consumer watchdog and attorneys general in three states are suing Libre by Nexus for allegedly preying on immigrants in U.S. detention centers by misrepresenting fees for paying bail bonds and threatening borrowers who cannot repay.

The Consumer Financial Protection Bureau (CFPB) and attorneys general in New York, Massachusetts and Virginia have sued Libre by Nexus and its parent company for alleged predatory practices that “bind the immigrants to years of exorbitant monthly payments,” the agency said on Monday.

Nexus Services did not respond immediately to requests for comment.

Libre allegedly lured immigrants with misleading statements and falsely threatened them with potential re-arrest, detention or deportation when they did not make their repayments, the regulators said in a statement.

The lawsuit, filed on Monday against Libre, parent company Nexus Services Inc and firm owners Micheal Donovan, Richard Moore and Evan Ajin, seeks to halt the practices and obtain relief for victims. The firm has previously reached settlements with other regulators over its controversial practices.

On Monday, CFPB Acting Director David Uejio in a statement described Libre as a “wolf in sheep’s clothing,” saying the Bureau is prioritizing the case to send a signal that financial scams targeting communities of color will not be tolerated.

“This case is a prime example of how people of color are targeted in financial scams and the latent inequity that is too often found in the market for financial products and services,” Uejio said in the statement. “The Bureau won’t stand for it.”

Follow NBC Latino on Facebook, Twitter and Instagram.

Source: | This article originally belongs to Nbcnews.com