Aside from the final Presidential debate, dollar traders have a bunch of FOMC speeches to look forward to this week.

Will these catalysts provide one-directional trends for the Greenback?

Check out the market themes other dollar traders will likely pay attention to!

Lower-tier economic releases

- Building permits and housing starts (Oct 20, 12:30 pm GMT) are expected to show higher numbers than last month’s readings

- The beige book report (Oct 21, 6:00 pm GMT) last reported lower economic activity in September. Analysts see the release printing an even weaker picture with emphasis on employment rather than inflation

- Initial jobless claims (Oct 22, 12:30 pm GMT) expected to print at 860K (from 898K)

- Existing home sales (Oct 22, 2:00 pm GMT) to slip from 6.0M to 5.9M in September

- Markit’s manufacturing PMI (Oct 23, 1:45 pm GMT) could slow down from 53.2 to 52.6 in October

- Markit’s services PMI is also expected to weaken from its 54.6 reading

FOMC members’ speeches

- With no stimulus deal in sight, expect Fed members to sneak in calls for fiscal support in their speeches

- FOMC Chairman Powell (Oct 19, 12:00 pm GMT) will participate in a panel discussion about digital currencies

- Richard Clarida (Oct 19, 3:45 pm GMT) will talk economic outlook and economic policy

- Patrick Harker (Oct 19, 7:00 pm GMT) is scheduled to speak about recovery from the COVID-19 recession

- John Williams (Oct 20, 1:00 pm GMT) will open a webinar series hosted by the Reserve Bank of New York

- Randal Quarles (Oct 20, 2:50 pm GMT) will speak about the Financial Stability Board’s agenda

- Lael Brainard (Oct 21, 12:50 pm GMT) will talk economic and monetary policy outlook at an online conference

- Loretta Mester (Oct 21, 2:00 pm GMT) will talk monetary policy at a virtual conference

Overall dollar demand

- As seen in last week’s price action, prospects of a stimulus deal will continue to affect the demand for the dollar

- Headline-making policy goals and changes ahead of the U.S. election can also influence the dollar’s price action

- The final debate between President Trump and former VP Biden can also move equity markets and take dollar demand along with it

- Pre-election jitters can limit U.S. equity gains and send traders into the safe-haven dollar

Technical snapshot

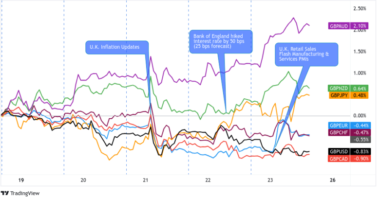

- The dollar has gained value against ALL of its counterparts in the last seven days

- It saw the most gains against AUD, EUR, GBP, and CAD

- EMAs show the dollar’s short and long-term bearish trends against GBP, CHF, NZD, and JPY

- Watch out for retracement or reversal opportunities on EUR/USD

- AUD remains above the 200 SMA even as it dips below its shorter-term EMAs

- USD was most volatile against GBP, AUD, NZD, and EUR in the last seven days

This post first appeared on babypips.com