It’s another busy week for the Greenback!

Has the economy really bounced by more than 30% in Q3 2020?

Check out what dollar traders are looking at for the week ahead.

Advance GDP report (Oct 29, 12:30 pm GMT)

- The first reading clocked in at -32.9%, which was slightly better than expected but still a pretty bad number

- USD fell across the board and didn’t come up for air until the next day

- This is Uncle Sam’s first growth reading for Q3 2020

- Analysts see a 30.0% jump after a 31.4% drop in Q2 2020

- A much better than expected release could inspire risk-taking and weigh on the safe-haven dollar anyway

Other closely watched data releases

- New home sales (Oct 26, 2:00 pm GMT) to gain by another 3.5% after a 4.8% jump in August?

- Durable goods orders (Oct 27, 12:30 pm GMT) seen gaining another 0.4% in September

- Core durable goods orders could inch 0.3% higher after a 0.4% print in August

- CB consumer confidence (Oct 27, 2:00 pm GMT) expected at 101.5 (from 101.8)

- Initial jobless claims (Oct 29, 12:30 pm GMT) to remain at 700K+ this week

- Core PCE price index (Oct 30, 12:30 pm GMT) – the Fed’s preferred gauge for inflation – is could slow down from 0.3% to 0.2% in September

Overall dollar demand

- Uncertainty over the outcome of the U.S. Presidential elections could inspire some traders to flee from the U.S. dollar

- Speculations of a stimulus deal will continue to provide volatility for the major currency pairs

- A closely watched, once-every-five-years meeting of the party head honchos in China can also influence overall risk-taking and the demand for the low-yielding dollar

- Top-tier reports from other economies, such as GDP releases in the Eurozone and policy announcements from the BOC, BOJ, and the ECB can also cause intraday volatility for the dollar

Technical snapshot

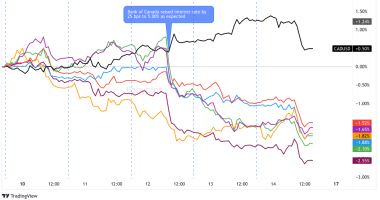

- The dollar has lost value against ALL of its major counterparts in the last month

- It saw its deepest losses against CHF, GBP, and NZD

- Stochastic considers the dollar “oversold” against the Kiwi, euro, and franc on the daily time frame

- USD/CAD and USD/JPY look ready to hit oversold status as well

- The dollar was most volatile against the Kiwi, pound, Aussie, and yen in the last seven days

This post first appeared on babypips.com