The Fed is up this week! What are markets expecting from the central bank?

More importantly, how long will it affect the dollar’s broader trends?

I’ve listed down a few points that might help you trade the Greenback this week:

FOMC Statement (Jan 27, 7:00 pm GMT)

- As expected, the Fed made no policy changes in December

- Governor Powell and his team raised their growth forecasts on vaccine optimism

- USD initially popped up but soon erased its gains when traders priced in the Fed’s continued bond-buying and dovish policies

- Market players don’t expect policy changes from the Fed this week

- The Fed could express optimism over the vaccine rollout and likelihood of more fiscal stimulus

- To avoid the markets getting ahead of themselves (and pushing long-term govt bond yields higher), Powell will likely cool down talks of any near-term tightening

Advance GDP (Jan 28, 1:30 pm GMT)

- The first reading of Q4 2020 GDP is expected to reflect the slower growth from tighter COVID-19 restrictions that led to lower employment and consumer activity (Bitcoin buying doesn’t count lol)

- Quarterly growth is seen at 4.0% from a 33.4% jump in Q3

- Much lower economic activity would highlight the need for more stimulus and faster vaccine distribution

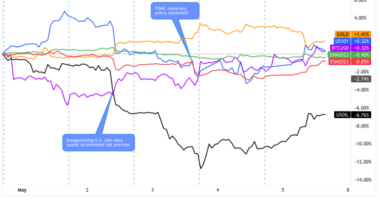

Overall dollar demand

- Expectations of stimulus in the U.S. could continue to promote risk-taking and weigh on the dollar this week

- Disappointing U.S. earnings reports, doubts on the size and schedule of the stimulus bill, global lockdown prospects, and end-of-month profit-taking could push the safe-haven dollar higher against its higher-yielding counterparts

Technical snapshot

- Stochastic considers the dollar “oversold” against the pound on the daily time frame

- USD is mostly in neutral zones against its other counterparts

- EMAs show the dollar’s short AND long-term bearish trends against most of its major counterparts

- We could be seeing retracement or reversal setups on USD/JPY this week

- The dollar was most volatile against the comdolls and the pound in the last seven days

Missed last week’s price action? Read USD’s price recap for Jan. 18 – 22!