CAR insurance costs have jumped up a whopping £100 on average according to research by one comparison site, with Brits already facing tightening budgets due to the cost-of-living crisis.

Driving has become increasingly unaffordable, as 84% of motorists have spent more on fuel in the past six months.

And with insurance premiums sharply up this past year, households are under further pressure to save money.

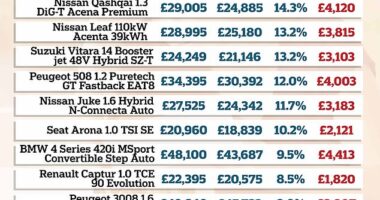

The data has been compiled by comparethemarket.com and outlines the top 10 most popular car models in the UK and their insurance prices.

The most popular car to insure between March and May 2022 is the Ford Fiesta Zetec.

But the annual premium for a Ford Fiesta Zetec now costs an average of £785 to insure – a massive £129 more compared to the same period in 2021.

Coming in as the second most popular model to insure effectively is the Mini Cooper.

Always a favourite among drivers, the Mini typically costs £617 per year to insure, rising by £87 from 2021.

For the third most popular car, the average premium for the Fiat 500 Lounge has increased by £57 year-on-year,

However, insurance for a Fiat 500 Lounge costs an average of £521 – making it the cheapest car to insure out of the ten most popular.

Most read in Money

Different models of the Ford Fiesta Zetec, 80 and 99 respectively, also rank in the top ten most popular list.

And the Vauxhall Corsa SXI has increased a whopping £134 to £882 – making it the most expensive out of the popular cars to insure.

The rest of the top ten cars are made up of the Mini One, Fiat 500 Pop, Peugeot 107 Urban and another Ford, in the shape of the Fiesta Zetec Climate.

If drivers are looking for a car with low running costs, buying one of the cheaper cars to insure can lead to substantial savings.

Motorists could save an average of £361 per year by choosing a Fiat 500 Lounge instead of a Vauxhall Corsa SXI.

It should be noted that your insurance costs will vary based on a number of factors including car model, mileage, driving history and post code to name a few.

Alex Hasty, director at comparethemarket.com, said: “Car insurance is usually one of the most expensive running costs for drivers, so the increase in premiums will be unwelcome, particularly in the current climate when household finances are being squeezed significantly.

“Insurers use many factors to calculate car insurance premiums, based on the individual and their driving, as well as the make and model. Normally, the bigger the engine your car has, the higher the insurance premium.”

How to cut your car insurance costs now

With the rise in insurance out of your control, here are some quickfire ways to cut insurance costs.

Increase your excess

Premium is the amount you pay for your insurance while excess is what you agree to pay when you have a claim.

You can choose your own excess and the higher it is, the lower your premium.

Go fully comprehensive

Fully comprehensive policies can actually be cheaper as insurers may associate third-party cover with higher risk drivers.

It can also work out cheaper if you do have to make a claim as it will cover the cost of fixing or replacing your vehicle.

Pay upfront

Your insurers usually give you the choice between paying monthly and upfront.

While tricky to get together a lump sum, paying upfront can save you money as there are no extra interest charges that come with monthly payments.

Shop around before renewing

Car insurance policies typically auto-renew but insurers rarely offer the best deals to their existing customers.

You can use comparison websites and shop around to make sure you secure the best deal for yourself before making another decision.

Change your job title

Some jobs are seen as more risky than others for insurance purposes.

Making small but accurate changes to your job title or profession may save you money.